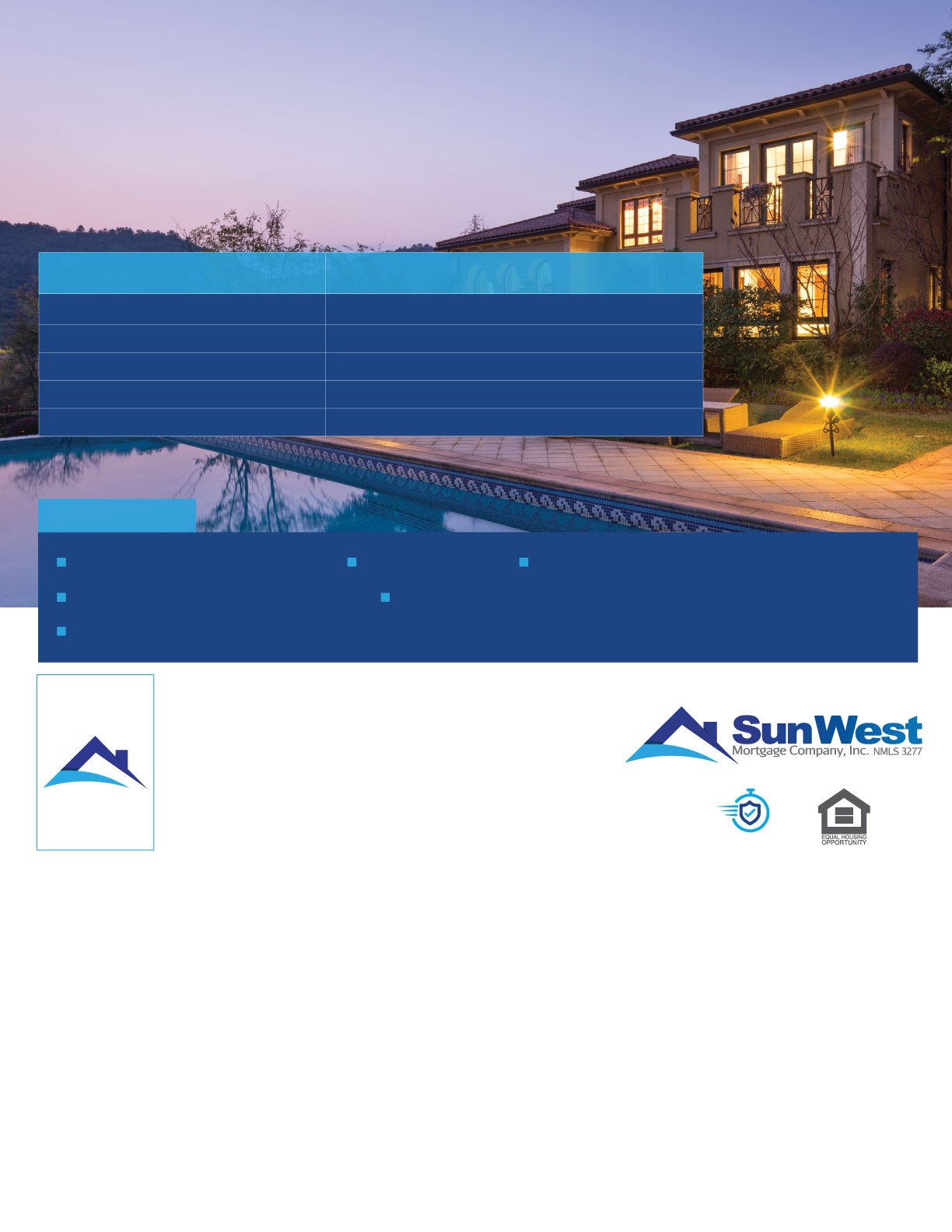

Non-QM and Non-conforming

Jumbo Loan Program

Non-QM Loan Programs

Non-Conforming Jumbo Loan Programs

EZ A+ Program**

EZ Flex+ Program**

Foreign National Program**

EZ DSC Program**

ITIN: ALT A Premier Program

Prime Jumbo Fixed Rate Program

Prime Jumbo ARM* Program

JR TIER 2 Program

JR TIER 3 Program

AUS Program

Features:

LTV up to 90%1

Loan amounts up to $3.5M

Interest-only Option Available

No Private Mortgage Insurance

Program available for Foreign National Borrowers

Alternative Qualification Option Available

Sheila Lopez

NMLS 1758286

Loan Officer

D: (787) 330-0590 | M: (787) 297-9093

sheila.lopez@swmc.com

sheilalopez.lowratespr.com

101 San Patricio Avenue, Maramar Building Suite G1

Guaynabo, PR 00968

Home of Fair Lending

Branch NMLS 516931

*This is an Adjustable Rate Mortgage.

1For Purchase Transaction, 10% cash required from borrower in case of 90% LTV.

Our products and services have no affiliation with or endorsement from any government agency or body.

Being High Risk Loans, Non-QM and Non-Conforming Jumbo loans may include higher interest rates, closing costs, Interest-Only periods or Pre-payment penalties.

On a Non-QM EZ A+ 30-year fixed rate purchase with loan amount $1,500,000 (at 90% LTV with 10% cash required from borrower and FICO 740), at an interest rate 5% with $23,265 discount points (Annual Percentage Rate: 5.339%), you will be required to make 360 equal monthly payments of $8,052.32 (which includes principal and interest only, so your actual payment, including taxes, insurance, and other property charges, will be higher).

All programs are not available in all states.

**Prepayment penalty is applicable on Investment Properties. Prepayment penalty of 6 months of interest on the amount prepaid that exceeds 20% of the original principal loan amount; if the loan is paid off within 5 years of closing. Prepayment penalty applicability differs from State to State and subject to State law.

Interest-only mortgages allow you to pay only the interest on the money you borrow for the first few years of the mortgage (the "interest-only period"). If you make interest-only payments, then at the end of the interest-only period you will still owe the original amount you borrowed and your monthly payment will increase because you must pay back the principal as well as interest. Your payments could increase even more if you have an Adjustable Rate Mortgage (ARM) and interest rates increase.

For Puerto Rico residents only. Sheila Lopez is licensed in PR. All products are subject to credit and property approval. Program terms and conditions are subject to change without prior notice. Other restrictions and limitations apply. The content here does not substitute for professional legal, securities, tax or accounting advice. Sun West Mortgage Company, Inc. (NMLS ID # 3277, www.nmlsconsumeraccess.org) as a Mortgage Banker in Puerto Rico holds a Mortgage Lender/Servicer License (Concesionarios /Administradores de Préstamos Hipotecarios #IH-138), a Mortgage Lender/Servicer License (#IH-138-01) for the Guaynabo, PR Branch Office (NMLS ID 516931) located at 101 San Patricio Avenue, Maramar Building Suite G1, Guaynabo, PR 00968, licensed by Puerto Rico Commissioner of Financial Institutions, Phone: (787) 723-8403. For licensing information, go to: www.nmlsconsumeraccess.org. Visit http://www.swmc.com/swmc/disclaimer.php for the full list of license information. In all jurisdictions, the principal (Main) licensed location of Sun West Mortgage Company, Inc. is 6131 Orangethorpe Avenue, Suite 500, Buena Park, CA 90620, Phone: (800) 453-7884.